Indian steel giant Tata's plans to sell off its British assets has sent shock waves through an already-turbulent British Steel industry.

A staggering 40k jobs could be lost, if no one is willing to buy Tata's assets. To put this into perspective, imagine Wembley Stadium being at full capacity, and then someone telling about half the crowd that they're being laid off.

If private investors refuse to buy the assets, there's always the chance that the government could step in, and perform an interventionist manoeuvre, otherwise known as nationalisation.

However, when asked about the Steel crisis, the Prime Minister told Sky News earlier today: "I don't believe nationalisation is the right answer".

Readers might recall how the government bailed out and nationalised a handful of British banks, including RBS and HBOS. It's an easy comparison to make, surely?

Twitter user Primly Stable added some perspective to the nationalisation debate, after some users tried to compare the steel industry to the banking sector, during the 2008 crisis.

Source: @PrimlyStable (Twitter)

Labour leader Jeremy Corbyn strongly urges that Parliament be re-called, to debate the issue, given the number of peoples' careers being at stake.

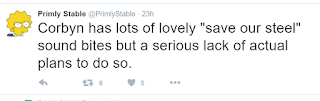

Primly Stable added some further commentary on Jeremy Corbyn's position.

Source: @PrimlyStable (Twitter)

An e-petition for Parliament to be re-called has rapidly gained traction. Late last night, it had only attracted about 7k signatures, but this has since swollen to well over the 100k level (116.5k as of Thursday 31st March).

Now this number of signatures has been reached, MPs are compelled to debate the issue, at a forthcoming session in the House of Commons.

It's a slightly confusing strategy; MPs, owing to sheer public pressure, will probably want to raise the issue regardless.

Organising for a debate about re-calling Parliament, to talk about the steel crisis, when MPs will be doing it anyway makes the whole thing seem well-intentioned but some might say it's a little bit pointless. Debating is a pretty vital part of an MP's job.

Fraying nerves of Steel

Signs of trouble for British Steel were already apparent back in late 2015, when Chinese President Xi Jinping visited the UK. The visit was made awkward, when some started to accuse China of dumping massive amounts of Steel into European markets.

As any economics professor will tell you, when the quantity of a commodity (e.g. Crude Oil) increases, the overall value of the commodity (e.g. each barrel of Oil) diminishes. The same applies for steel.

As China's industrial boom starts to slow, and the economy rebalances towards domestic consumption, the glut in industrial materials it produces are starting to find new homes on stranger shores.

As shown below, the value of a metic ton of steel has been see-sawing, since the global financial crisis. It's been especially downbeat since it peaked in 2015, at 500 USD per MT. It has since tumbled all the way down to just 90 USD per MT.

It's even worse, when you consider that Steel prices were at a lofty 1265 USD per MT back in 2008. This crash in commodity prices in general is, in large part, responsible for the wave of deflation we've seen, particularly in Western economies.

No comments:

Post a Comment